what food items are taxable in massachusetts

The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam or certain. Although Massachusetts still levies a 625 percent sales tax on most tangible items there are quite a few exemptions including food healthcare items and more.

Massachusetts Income Tax H R Block

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

. Grocery items are generally tax exempt in Massachusetts. Food clothing items under 175 admissions sales and most utilities and heating fuel are exempt from the Massachusetts sales tax. Massachusetts has one sales tax holidays during which certain items can be purchased sales-tax free.

The purchase included 3800 worth of tax exempt items and 1200 worth of food that may be purchased with food stamps but is subject to Massachusetts sales tax unless. This includes soft drinks candy and other food types that many other states consider taxable. Business purchases for resale are also exempt.

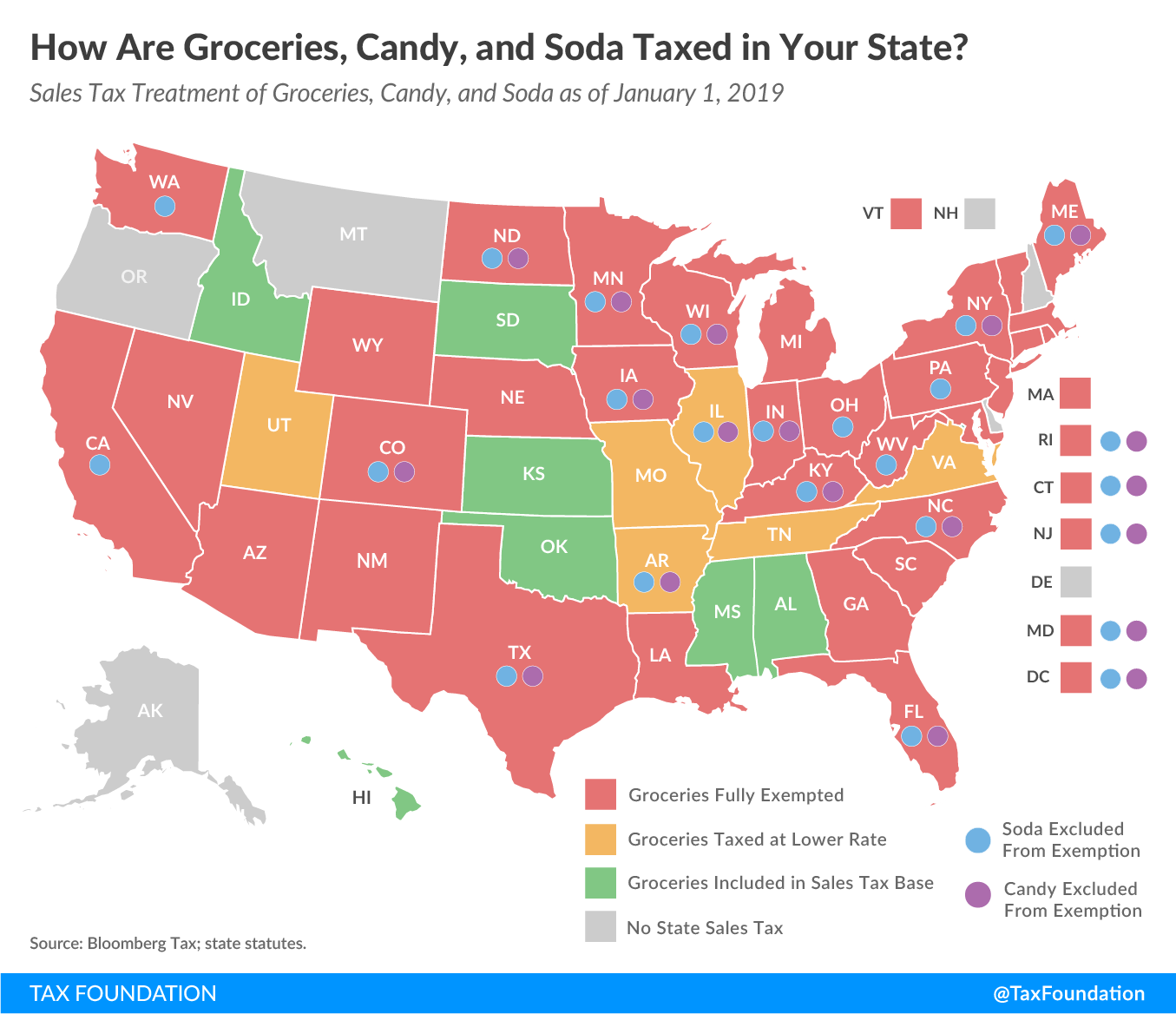

In the state of Massachusetts sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Treat either candy or soda differently than groceries. Twenty-three states and DC.

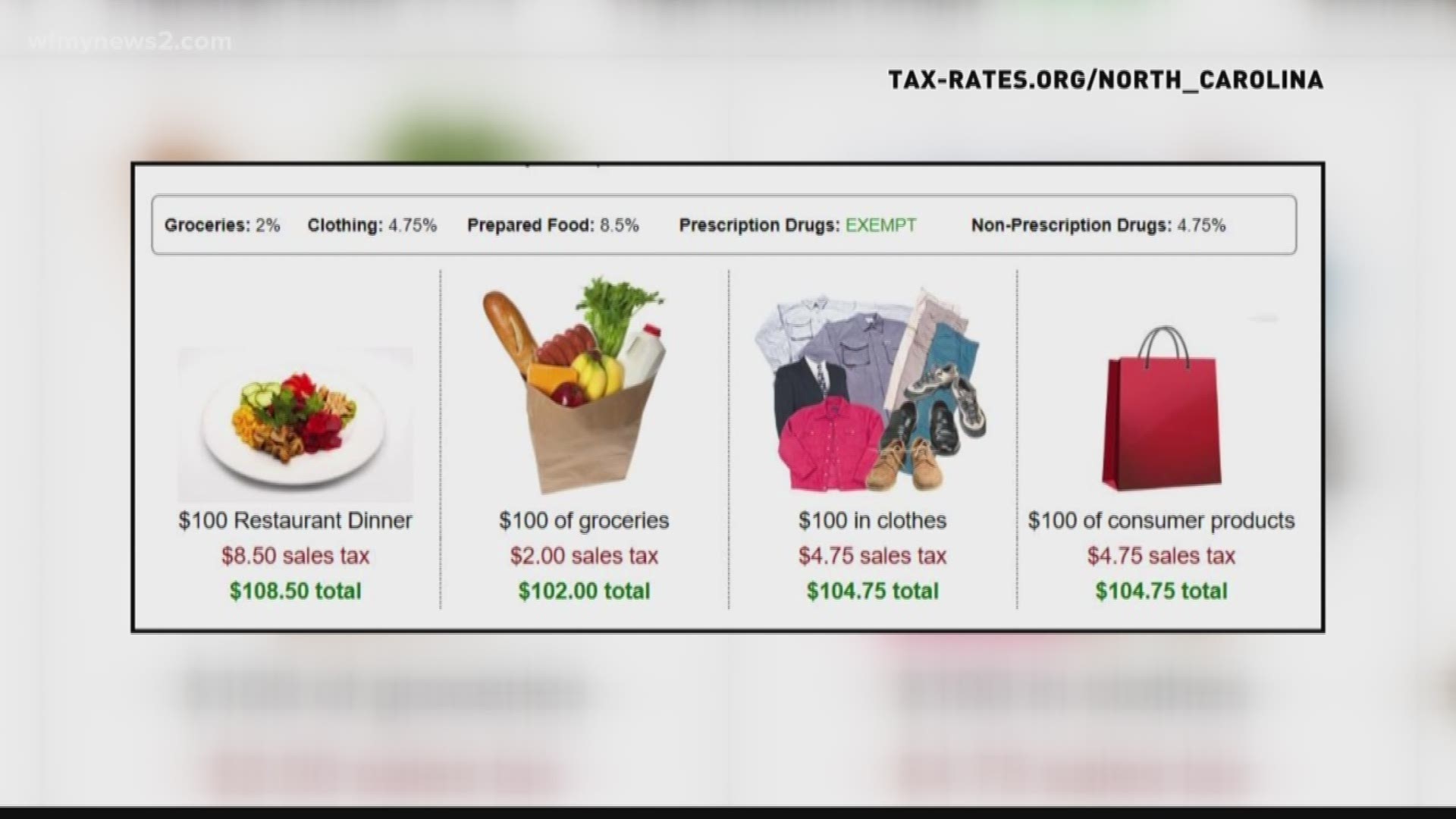

This page describes the. The meals tax rate is 625. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

This includes sales tax on items like food or restaurant meals. Major items exempt from the tax include food not ready-to-eat. This post will dig into how the state of Massachusetts handles grocery food and restaurant meal taxability.

Taxable food and beverage items may be purchased for resale without payment of tax if the purchaser gives the seller a properly completed Form ST-120 Resale Certificate. Several examples of exceptions to this tax are. Eleven of the states that exempt groceries from their sales tax base include both candy and.

44 rows In the state of Massachusetts sales tax is legally required.

New Hampshire Sales Tax Rate 2022

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Your Guide To Massachusetts Tax Free Weekend 2022

Shop Tax Free Weekends To Save On School Supplies Krazy Coupon Lady The Krazy Coupon Lady

Sales Tax On Grocery Items Taxjar

Online Menu Of Pho Basil Restaurant Boston Massachusetts 02115 Zmenu

Massachusetts Income Tax Rate Will Drop To 5 On Jan 1 Masslive Com

Meals Tax Helps Budget Gaps In Massachusetts Cities And Towns Masslive Com

Is Food Taxable In Massachusetts Taxjar

Online Menu Of Pizza Tyme Restaurant Norton Massachusetts 02766 Zmenu