new orleans sales tax calculator

A full list of these can be found below. The average cumulative sales tax rate in Orleans Nebraska is 55.

Alabama Sales Tax Guide For Businesses

The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish.

. The sales tax rate does not vary based on zip code. Sales Tax Forms. The Parish sales tax rate is.

Thinking about a move to New Orleans. Use this New Orleans property tax calculator to estimate your annual property tax payment. This includes the sales tax rates on the state county city and special levels.

SalesUseParking Tax Return French Quarter EDD Imposed A New SalesUse Tax Rate at 0245 effective Beginning October 1 2021 Ending June 30 2026 Form 8010 Effective Starting July 1 2019. State tax. Calculator for Sales Tax in the Orleans.

You can print a 945 sales tax table here. Before-tax price sale tax rate and final or after-tax price. The average cumulative sales tax rate between all of them is 8.

The sales tax rate does not vary based on zip code. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Counties cities and districts impose their own local taxes.

Average Local State Sales Tax. The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax. Orleans is located within Harlan County Nebraska.

Form 8071 Effective Starting October 1 2021 Present. The most populous location in Orleans Parish Louisiana is New Orleans. The effective rate change of 5 should be made immediately.

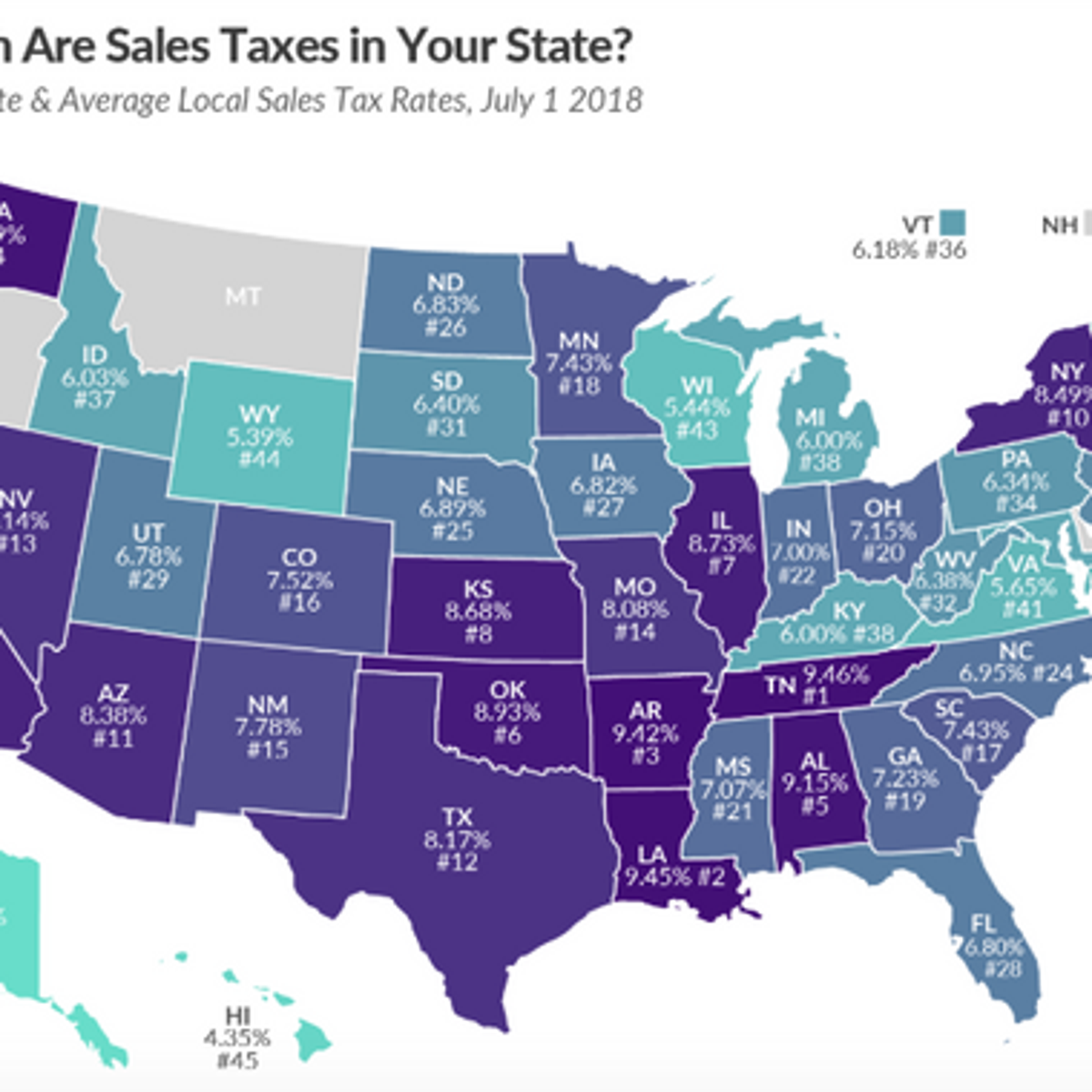

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Louisiana has a 445 statewide sales tax rate but also has 265 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 5078 on. SOLD JUN 13 2022.

Our websites calculate the taxes due automatically. Sales Tax Calculator Sales Tax Table. There are also local taxes of up to 6.

What is the sales tax rate in New Orleans Louisiana. And several of these states raise nearly 60 percent of their tax revenue from the sales tax. SOLD MAR 17 2022.

The current total local sales tax rate in New Orleans LA is 9450. Within Orleans there is 1 zip code with the most populous zip code being 68966. The City of New Orleans today reminded.

On the Parish E-File website you may pay your City of New Orleans and State of Louisiana sales taxes. You can find more tax rates and allowances for Orleans Parish and Louisiana in the 2022 Louisiana Tax Tables. You do not have to calculate the amount of tax due.

Calculator for Sales Tax in the Orleans. All establishments are required to charge 5. Did South Dakota v.

The sales tax rate does not vary based on location. It is designed to give you property tax estimates for. A full list of these can be found below.

The most populous zip code in Orleans Parish Louisiana is 70122. In Baton Rouge the rate for that same type of meal is slightly higher at 995 since the local sales tax rate is 55. This is the total of state parish and city sales tax rates.

The average cumulative sales tax rate between all of them is 945. The New Orleans sales tax rate is. Nearby Recently Sold Homes.

New York on the other hand only raises about 20 percent of its revenues from the. Orleans Parish in Louisiana has a tax rate of 10 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Orleans Parish totaling 6. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

1439 Filmore Ave New Orleans LA 70122. The definition of a hotel according to Sec. The sales tax rate does not vary based on location.

The sales tax rate does not vary based on zip code. The minimum combined 2022 sales tax rate for New Orleans Louisiana is. 574000 Last Sold Price.

A full list of these can be found below. Maximum Local Sales Tax. Fill in price either with or without sales tax.

Tax Bill Payments. The results are rounded to two decimals. You can print a 945 sales tax table here.

The definition of a hotel according to Sec. There is no applicable city tax or special tax. The most populous location in Orleans County New York is Albion.

Credit cards are accepted on the httpsservicesnolagov website only. Did South Dakota v. There is base sales tax by New York.

Maximum Possible Sales Tax. US Sales Tax New York Sales Tax calculator Orleans. The Louisiana LA state sales tax rate is currently 445.

Click on links below to download tax forms relating to sales tax. Louisiana State Sales Tax. Nearby homes similar to 21 Egret St have recently sold between 320K to 650K at an average of 230 per square foot.

The outbreak of COVID-19 caused by the. For tax rates in other cities see Louisiana sales taxes by city and county. USA Tax Calculator 2022.

The City of New Orleans sales tax rate on renting of any sleeping room will increase from 4 to 5. The Louisiana sales tax rate is currently. The most populous zip code in Orleans County New York is 14411.

The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax. USA Tax Calculator 2022. New sales tax users.

Department of Finance Bureau of Revenue - Sales Tax 1300 Perdido St RM 1W15 New Orleans LA 70112. The December 2020 total local sales tax rate was also 9450. 150-874 of the City Code includes any establishment or person engaged in the business of furnishing sleeping rooms cottages or cabins to transient guests.

The city of New Orleans is. Use this New Orleans property tax calculator to estimate your annual property tax payment.

New Orleans Louisiana S Sales Tax Rate Is 9 45

Louisiana Income Tax Calculator Smartasset

Missouri Sales Tax Guide For Businesses

New York Sales Tax Calculator Reverse Sales Dremployee

New York Sales Tax Guide For Businesses

Louisiana Sales Tax Small Business Guide Truic

Nevada Sales Tax Guide For Businesses

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Washington Sales Tax Guide For Businesses

Louisiana Vehicle Sales Tax Fees Find The Best Car Price

Infographic New Orleans Travel Surges

Follow Avalara S Avalara Latest Tweets Twitter

How To Calculate Sales Tax Video Lesson Transcript Study Com

Sales Tax On Grocery Items Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Louisiana Sales Tax Changes Laporte

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com